Any opportunities left in the South East Asia cross-border market in 2022? An Updated analysis to the South East Asia Market

See what is happening in eCommerce industry.

Any opportunities left in the South East Asia cross-border market in 2022? An Updated analysis to the South East Asia Market

looking at the cross-boarder market globally, Incomparison to the relatively mature Western Markets, South East Asia market is becoming a haven for newbie and startup cross-boarder sellers in search for emerging and potential markets.

What’s the outlook for the South East Asia Market in 2022?

Affected by the pandemic during 2019 – 2021, numerous Chinese cross-borader sellers and investers are expriencing unprecedented market shifts. So what about the South East Asia Markets?

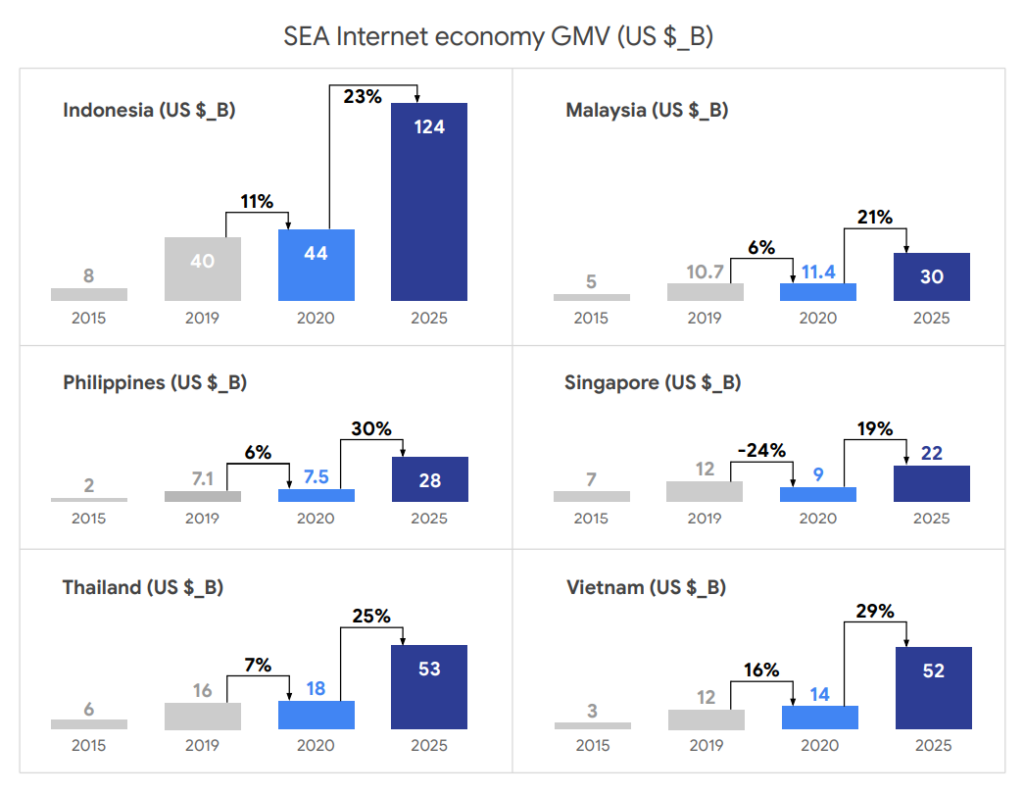

There is no doubt about the prospects of the Southeast Asian market in 2022. Under the shadow of the Covid-19, the global economic growth has been slowing down and many countries have even experienced declines to varying degrees. However, the pandemic had turned out to be an catalyst for the South East Asian eCommerce market. It is expected that there will be 19 – 30% increase in the GMV. According to the “2021 Southeast Asia Digital Economy Report” jointly released by Temasek, Google and Bain recently, Singapore, Indonesia, Malaysia, the Philippines, Thailand and Vietnam will have 19%-30% GMV growth in the Internet economy from 2020 to 2025. Since the outset of the pandemic, the scale of Southeast Asia’s digital economy (GMV) has reached 174 billion US dollars. By 2025, the scale of Southeast Asia’s digital economy is expected to exceed 360 billion US dollars, and it is expected to reach 1 trillion US dollars by 2030.

What are the pain points of South East Asia in 2022?

(1)The eCommerce environment lacks policy support from all parties to the transaction, and online shopping is not as widely accepted.

Local e-commerce platforms in Southeast Asia are usually less experienced and are less competitive with their technologies, causing the majority of them to be suppressed by international e-commerce platforms. The domestic e-commerce market is occupied mainly by e-commerce companies based abroad. At the same time, online shopping is not as widely accepted as it is in Europe and North America, and transaction fraud is raising major concerns. In the year 2022, paying extra attention to online shopping fraud should be one of the to-dos on the seller’s list.

(2) Problems with Tariffs and Logistics

The timeliness and stability of logistics in Southeast Asia are also problems specific to the Southeast Asian market. Compared with Europe and the United States, the logistics system is still quite primitive. In countries like Indonesia, the shipment transit duration might take up to 15 to even 20 days in the past. Another thing to keep in mind is the issue of tariffs. When doing cross-border e-commerce in Southeast Asia, note the different tariff policies in different countries. In Indonesia where the customs clearance process is poorly regulated, the problem of corruption is prominent.

(3) How to truely achieve Localization?

The cultures of Southeast Asian countries and China may seem to be similar, but in fact, there are significant differences in the cultural heritage, way of doing things, and decision-making habits of these countries and regions. Cultural differences lead to differences in behavior, and differences in behavior lead to different outcomes. To break the cultural barrier, we have to realize that language is a powerful business driver that can improve the profitability of cross-border e-commerce. The situation is that the languages in the Southeast Asian market are scattered out, and most of them are lesser-spoken languages. The operating costs to achieve localization is considerably high. About 67% of the surveyed companies believe that partners and sales teams using the local language will better understand the local culture and will bring more profits to cross-border e-commerce.

With the cross-border e-commerce booming in China, Selling overseas to the Southeast Asia region is entering a golden age: the effect of improving environment, implementing of supporting policies, and the entry of capital are superimposed, congregating overseas business opportunities to Southeast Asia. We look forward to the Southeast Asian market in 2022, and we believe that there will be endless opportunities in the future Southeast Asian market awaiting Chinese sellers to continue to explore!

UPFOS has a strong advantages in localization and has been empowering Southeast Asian sellers to go overseas! It is a one-stop SaaS e-commerce retail management system that helps global e-commerce operators to become successful online sellers. With UPFOS, sellers can use one integrated platform to access and manage all data and business workflow with ease.

Unlock the full power of UPFOS and reach your business goals faster.

Get strategic and technical guidance from UPFOS experts.

Products and Services

Quick Link

©2022 UPFOS All rights reserved.