Trends of E-commerce Development in Southeast Asia

See what is happening in eCommerce industry.

Trends of E-commerce Development in Southeast Asia

Growing e-commerce spending in Southeast Asia comes with growing complexities for platforms and merchants alike.

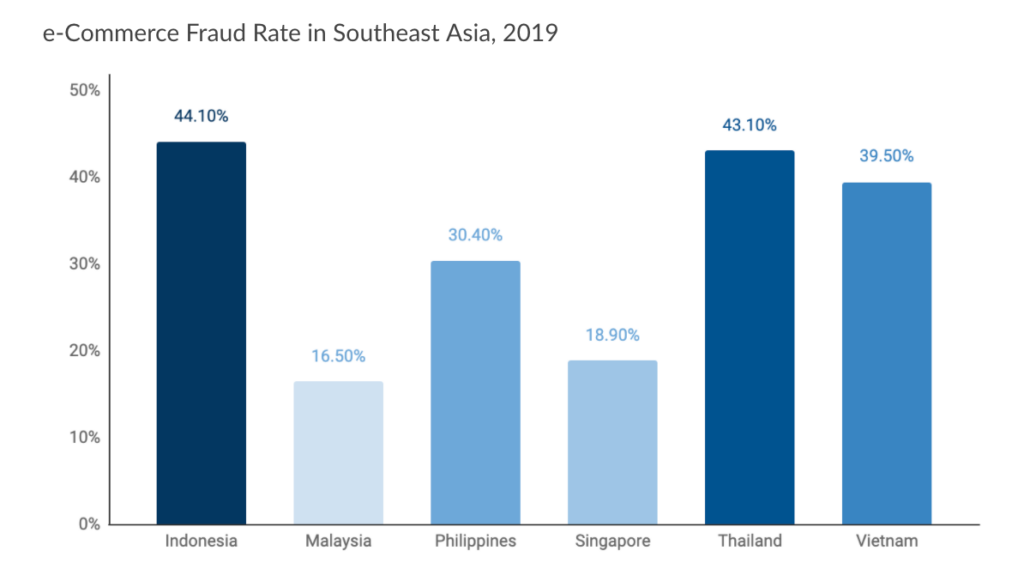

1. Rising fraud Rate

According to AppsFlyer’s Fraud Rising report, Southeast Asia stands to lose US$260 million to online fraud, with Thailand, Vietnam, and Indonesia expected to be the most heavily affected. Among the most common types of fraud in e-commerce are identity theft, phishing (posing as a trustworthy entity to acquire personal information like usernames and passwords), account takeover (illegally accessing someone’s account), mobile fraud, and chargeback fraud.

3. Working capital to scale

According to the World Economic Forum, 33% of SMEs lack access to credit in Southeast Asia. This problem is more acute in the Philippines, where a staggering 50% of SMEs do not have access to formal loans.2 Traditional banks typically require credit histories and collateral to underwrite a small business loan, both of which many newer SMEs may lack. We expect that more ‘e-commerce friendly’ financing options will be helpful here. For example, 500-backed Impact Credit Solutions built a digital credit platform that aims to increase credit availability for SMEs in Southeast Asia.

4. Multiple e-commerce channels

Southeast Asia has more than one dominant e-commerce platform – we’ve seen it with dominant marketplaces such as Lazada, Shopee, Tokopedia, and 500-backed Bukalapak. However, merchants are also setting up their own e-commerce storefronts and selling on social media platforms such as Instagram, Facebook, TikTok, or Whatsapp.

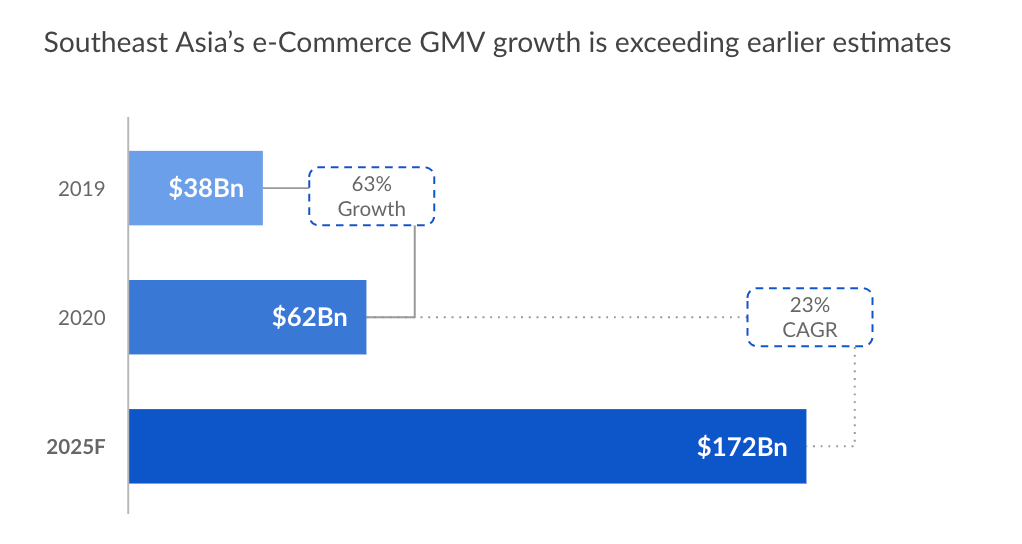

The e-commerce space saw a 63% growth between 2019 and 2020, with its value soaring to US$62 billion this year from US$38 billion a year earlier, according to the e-Conomy SEA 2020 report by Google, Temasek, Bain & Company. As such, it’s now expected to be worth US$172 billion by 2025 instead of the US$150 billion based on earlier estimates. We believe that platforms and merchants will want to pay for services to help them capture this spending.

The pandemic has increased the number of new e-commerce merchants, as offline retailers who have held out thus far are forced to adapt.

One example is the 500-backed Indonesian e-commerce marketplace unicorn, Bukalapak. In just the first 7 months of 2020, Bukalapak recorded over 3 million new merchants joining its e-commerce platform, with the strongest growth rates seen in rural areas and smaller cities.9 Bukalapak now serves 13.5 million micro, small and medium enterprises and 100 million customers.

- https://sea.500.co/blog/the-next-wave-of-e-commerce-empowerment-in-southeast-asia

- https://theaseanpost.com/article/asean-e-commerce-hit-fraud

- https://bit.ly/3mOyXYB

- https://ycharts.com/companies/SHOP/market_cap

- https://ycharts.com/companies/AFTPF/market_cap

- https://ycharts.com/companies/AFRM/market_cap

- https://tcrn.ch/32vwiK9

- https://www.bloomberg.com/news/articles/2019-12-02/singapore-app-lending-startup-scores-500-million-valuation

- https://vulcanpost.com/720018/pay-with-split-payment-instalment-zero-interest-malaysia/

- https://www.thejakartapost.com/news/2020/09/14/bukalapak-gains-3-million-new-merchants-mostly-in-smaller-cities.html

- https://www.cnbc.com/2021/02/02/bukalapak-indonesias-multibillion-dollar-warung-e-commerce-business.html

Unlock the full power of UPFOS and reach your business goals faster.

Get strategic and technical guidance from UPFOS experts.

Products and Services

Quick Link

Free Demo

One Platform, Million Possibilities.

©2022 UPFOS All rights reserved.